CSIS Scheme:- Through a program called the Central Sector Interest Subsidy Scheme (CSIS) 2024, students will have a proper opportunity to complete their education without having to worry about the financial difficulties they are experiencing. The features of this are detailed in the article below, and we’ll also inform you of all the prerequisites you need to fulfill to be considered for this prestigious program. We will also provide you with all the specific steps needed to submit an online application for the program.

Contents

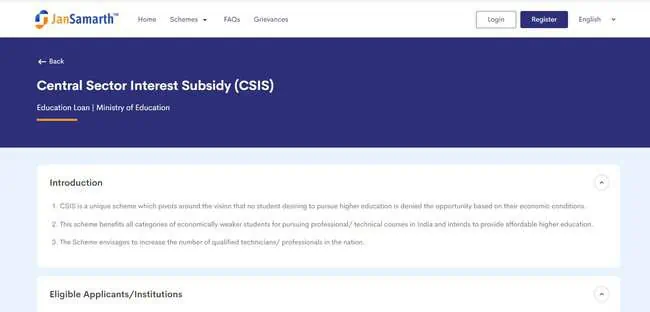

About Central Sector Interest Subsidy Scheme (CSIS) 2024

The core tenet of the highly regarded Central Sector Interest Subsidy Scheme is that students should pursue higher education and shouldn’t encounter any barriers in doing so, even if they originate from less wealthy backgrounds. The students will receive financial aid so they can enroll in professional and technical programs offered in India and receive an inexpensive higher education without worrying about their financial situation. The plan aims to boost India’s technician and professional workforce, enabling human resource development to function at full capacity.

Also Read:- Beti Bachao Beti Padhao Scheme

Features Of Scheme

The organization’s Central Sector Interest Subsidy Scheme has the following characteristics:

- The candidate must enroll in an approved technical or professional program in India.

- The Government of India shall pay the interest on the Educational Loan throughout the moratorium period, which is the Course Period plus an additional year, in accordance with the Scheme.

- After the moratorium, the student must pay interest on the remaining loan sum in line with the conditions of the Bank Model Educational Loan Scheme, which is subject to periodic updates.

- The State Government-designated Income Certifying Authority must issue a “Income Certificate” in order to certify the students.

- The Indian Ministry of Human Resource Development has sent an advisory to all State Governments asking them to identify suitable authorities or authorities qualified to issue income certificates under this plan, based on economic index rather than social background.

- Banks must carry out the plan in compliance with the notification on the certifying authority sent by State Governments via District Level Consultative Committees (DLCCs).

- The list and the signatures of the appropriate authorities to grant the income certificate will be provided to the DLCCs.

Eligibility for Interest Subsidy

For the applicant to be eligible for an interest subsidy under the esteemed plan, they must meet the following requirements:

- The maximum subsidy of Rupees 10 lakh will be provided, regardless of the approved loan amount.

- The qualifying students would only receive the interest subsidy under the scheme once, for their first undergraduate degree course or their postgraduate degree or diploma in India. Integrated courses (graduate + postgraduate) will, nevertheless, be eligible for interest subsidies.

- As per this agreement, students who withdraw from a course midway through or are expelled for academic or moral reasons will not be eligible for interest subsidies. Still, unless the termination was for medical necessity and all required evidence has been submitted to the satisfaction of the

- Canara Bank, the Nodal Bank for the Ministry of Human Resources Development, will implement the strategy.

- The program is in effect as of April 1, 2009, for the 2009–10 school year. Regardless of the date of sanctioning, the plan is only applicable to bank disbursements made on or after April 1, 2009, for the academic year 2009–2010. For loans approved prior to 1.4.2009 for courses starting prior to the 2009–10 academic year, interest subsidies are available up to the amount of payments made following 1.4.2009.

- In order to determine the exact timing of this payment, the Ministry of HRD should be informed. Interest subsidy claims for banks should be paid either half yearly or annually.

Approved Institutions/Courses

The following sites will offer students with information about the recognized institutions and courses.

- Centrally funded technical institutions

- Institutions of national importance

- NAAC-accredited universities/institutions

- NBA recognizes professional courses

Eligibility Criteria

For the candidate to be eligible for this plan, they must adhere to the following requirements:

- The applicant’s family’s annual income from all sources must not exceed Rs 4.5 lakh.

- The educational institutions in India where the students are enrolled must be accredited by regulatory agencies such as the NBA, CFTI, NAAC, or other organizations supporting technical or professional programs.

Also Read:– Nrega Job Card New List

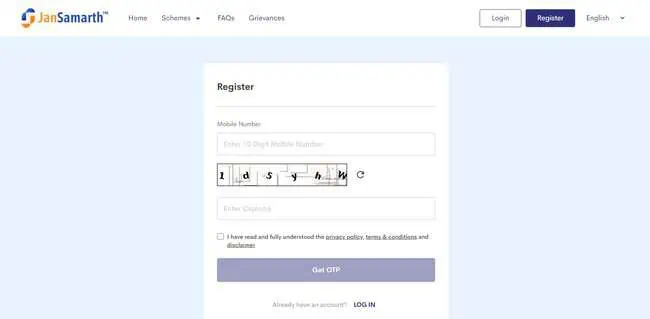

Central Sector Interest Subsidy Scheme (CSIS) 2024 Registration Process

To register yourself, simply follow the simple procedures listed below:

- You must first click on the provided link to access the scheme’s CSIS website.

- The homepage will load on your screen.

- Pay close attention to the details in the plan.

- Now is the time to choose the “Register” option.

- A new page will open on your screen. Your cellphone number must be entered in addition to the verification code.

- The terms and conditions must be accepted before you can register your phone number and create an account on the official website by clicking “get OTP.”

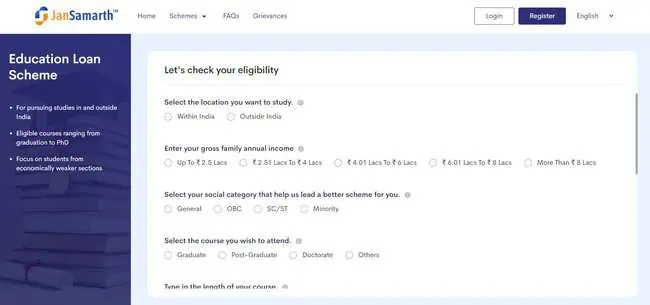

Verify Eligibility

You must adhere to the easy steps listed below in order to verify your eligibility:”-

- Initially, you must click on this link to access the scheme’s official website.

- On your screen, the homepage will open.

- Carefully read the information about the plan.

- You must now select the option labeled “Check Eligibility.”

- Your screen will open to a new page.

- You need to figure out the location and your gross family income.

- After inputting your social security number, choose the course.

- You must first decide on the course’s duration before deciding on its kind.

- Enter the amount you wish to invest right now together with your course fees.

- To determine your eligibility, you must select the Calculate Eligibility option.

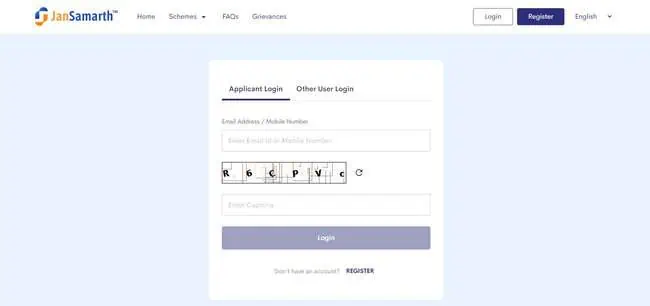

Login Process

To log in to the official website, simply follow the steps listed below:-

- You must first click on the provided link to access the scheme’s official website.

- The homepage will load on your screen.

- Go through the plan’s details with great attention.

- You must now select the “Login” option.

Also Read:- Agneepath Scheme Apply

- You’ll see a new page open on your screen with an email address field.

- To successfully log in, enter the captcha code and click the login button.

- Click on the other user’s login link and complete the necessary information to properly log in if you wish to log in as that user.

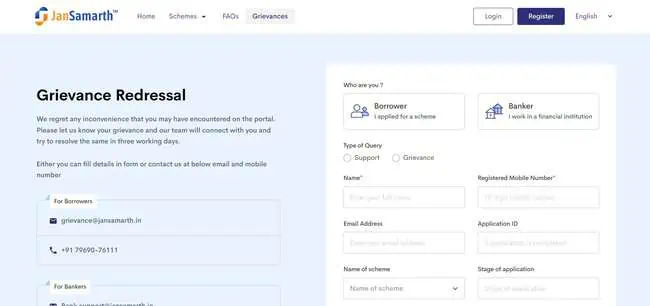

File A Complaint

To lodge a complaint, you must adhere to the straightforward process listed below:

- You must first click on the provided link to access the scheme’s official website.

- Your screen will open to the homepage.

- Go through the plan’s details with great attention.

- You now need to select the Grievances option.

- On your screen, a new page will open. In order to complete the application form, we must choose your question and input the requirements pertaining to your personal data.

- Give a detailed explanation of your grievance.

FAQ’s

Q. What is the CSIS Scheme maximum limit?

Asn- 4.5 lakh annually (from every source). The corresponding State Governments have granted permission to the designated authorities to provide proof of income under this plan. Nodal Bank: Canara Bank serves as the scheme’s nodal bank for both execution and oversight.

Q. Who is not qualified for a subsidy from CSIS?

Ans- Under this plan, students who drop out of school in the middle of their studies or are expelled for academic or disciplinary reasons will not be eligible for interest subsidies.

Suggested Link:- Our Jharkhand

@PAY