Mudra Loan Yojana: Mantri Pradhan Mudra Loan Yojana was introduced by the Prime Minister of our nation Shri Narendra Modi. If any citizen wishes to launch his small enterprise, the PM Mudra Loan Yojana offers loans totalling ₹ 1000000 to the nation’s residents. By applying under the Mudra Yojana, you may easily acquire a loan of up to ₹ 1000000 if you have money or wish to develop your business. We will explain the application procedure for this plan and the necessary paperwork in this article. You are asked to read this article through to the end to obtain all the information relating to the plan, including what it is, how to qualify for it, its advantages, and other details.

Also Read: CGTMSE Scheme

Contents

Pradhan Mantri Mudra Yojana 2024

Let us tell you that the Central Government created a budget of Rs 3 lakh crore for Mudra loans, of which Rs 1.75 lakh crore have been disbursed thus far. There won’t be any processing fees for borrowers who wish to take up a loan under the Mudra Yojana 2024. The loan payback time has been extended by five years under this arrangement. Under the Prime Minister Mudra Loan Scheme, each citizen of the nation receives a Mudra card, enabling them to apply for a Mudra loan.

The amount provided so far under Pradhan Mantri Mudra Loan Scheme

| Financial year | PMMY loans sanctioned (in million) | Amount sanctioned (in Rs crore) | Amount disbursed (in Rs crore) |

| 2021-22 | 53.7 | 3,39,110 | 3,31,402 |

| 2020-21 | 50.7 | 3,21,759 | 3,11,754 |

| 2019-20 | 62.2 | 3,37,495 | 3,29,715 |

| 2018-19 | 59.8 | 3,21,723 | 3,11,811 |

| 2017-18 | 48.1 | 2,53,677 | 2,46,437 |

Details Of PM Mudra Loan Yojana

| Name of the Scheme | Prime Minister Mudra Loan Scheme |

| Started by | By Prime Minister Narendra Modi |

| Beneficiary | people of the country |

| Objective | provide loan |

| Official Website | https://www.mudra.org.in/ |

Objective of PM Mudra Yojana

This scheme’s primary goal is to help the numerous humans within the country who wish to release their agencies but are not able to do so due to a loss of investment. the crucial authorities launched the Pradhan Mantri Mudra loan scheme in particular for these people. beneficiaries may additionally use a mudra mortgage to launch their very own small business before 2024. moreover, this plan makes it very simple to lend cash to others. thru the Pradhan Mantri mudra loan scheme 2024, the state’s citizens will have their desires fulfilled and could benefit from self-reliance and empowerment.

Know how gold is extracted in India?

How much loan is available under Mudra Yojana:

Under this arrangement, three different kinds of loans are available.

- Shishu Loan: This type of loan allows for loans up to Rs 50,000.

- Kishore Loan: Loans between Rs 50,000 and Rs 5 lakh are provided under this scheme.

- Tarun Loan: Loans between Rs 5 lakh and Rs 10 lakh are provided under this scheme.

Banks covered under the Mudra Scheme

- Allahabad Bank

- Bank of India

- Corporation Bank

- ICICI Bank

- j&k bank

- Punjab and Sindh Bank

- Syndicate Bank

- Union Bank of India

- Andhra Bank

- Bank of Maharashtra

- Dena bank

- IDBI Bank

- Karnataka Bank

- Punjab National Bank

- Tamil Nadu Mercantile Bank

- Axis Bank

- Canara Bank

- Federal Bank

- Indian Bank

- Kotak Mahindra Bank

- Saraswat Bank

- UCO Bank

- Bank of Baroda

- Central Bank of India

- HDFC bank

- Indian Overseas Bank

- Oriental Bank of Commerce

- State Bank of India

- Union Bank of India

Also Read: Joyalukkas Gold Scheme

Beneficiaries of PM Mudra Loan Yojana

- sole proprietor

- partnership

- service sector companies

- micro industry

- repair shops

- truck owners

- food-related business

- Seller

- micro manufacturing form

Eligibility for Pradhan Mantri Mudra Loan Yojana 2024

- Primarily, the Prime Minister Mudra Loan is available to all Indian citizens.

- The minimum age requirement is eighteen.

- It is necessary to have both a PAN and an Aadhar card to apply for a Mudra loan.

- The citizen’s civil score ought to be high. That is, he would have had to have been timely in making loan instalment deposits if he had ever taken out a loan from the bank.

- The candidate must not have any outstanding balances with any Indian banks.

- It should already be the case that the applicant has a bank account with the previous three years’ balance accessible.

- The individual seeking the loan must provide the original certificate to the bank as well as information about his firm.

- If a company owner is engaged in

Necessary documents required for PM Mudra Yojana

- The Aadhaar card of the loan applicant

- PAN card

- Pradhan Mantri Mudra Yojana Form

- two passport-size photographs

- permanent residence certificate

- office address

- business certificate

- Enterprise Registration Certificate

- GST number of the company

Pradhan Mantri Mudra Loan Yojana Apply Online

Read the details provided below if you’re interested in learning how to apply for a Mudra Loan as well. You must apply to receive a Mudra Loan. Please adhere to the online application procedure that we have outlined below.

- Visit the Mudra Loan Scheme’s official website first.

- The PM Mudra Loan Scheme home page will now appear in front of you, offering you a variety of possibilities.

- Baby

- Teen

- Tarun

- Thereafter, you’ll be presented with a new page.

- The Application Form is available for download on this website only.

- Following that, you will need to print this application.

- The application form now requires you to carefully fill in all of the pertinent information.

- Following this, all necessary papers must be attached.

- This application form has to be turned in to the bank that is closest to you right now.

- The loan will be issued to you in less than a month following application clearance.

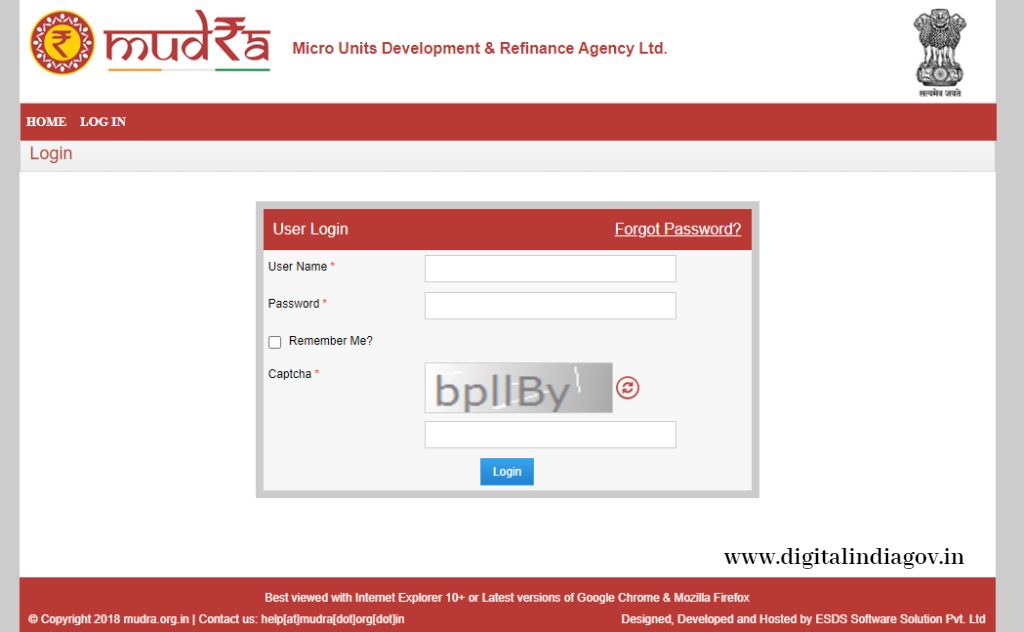

The process to login to Mudra Portal

- First of all, you should go to Mudra Yojana’s official website.

- It’s going to now open to the home web page in front of you.

- The login button ought to be clicked on the principal page.

- You will now be presented with a new page where you must enter your password, username, and captcha code.

- You must now click the icon to log in.

- You will be able to access the Mudra portal by doing this.

How to apply for Pradhan Mantri Mudra Loan Scheme?

- Interested beneficiaries of this plan may apply for a loan by going to the government, private, rural, or commercial bank that is closest to them and applying together with all necessary paperwork.

- Following that, fill out the application at the bank where you wish to obtain a loan.

- Once the paperwork is filled out, send it to the bank official together with all of your supporting documentation.

- Afterwards, the bank will grant you the loan within a month of reviewing all of your documentation.

Also Read: Swadhar Yojana

FAQ’s

Q: How to take advantage of Pradhan Mantri Mudra Yojana?

Ans: Loan amounts under the Mudra Loan Scheme range from ₹50,000 to ₹100,000. Under Shishu cover, loans up to Rs 50,000 are offered. Loans up to ₹500000 are provided under Kishore cover and loans up to ₹1000000 are provided under Tarun cover.

Q: What is Pradhan Mantri Mudra Yojana? Tell us about it.

Ans: Pradhan Mantri Mudra Yojana (pmmy) is a scheme of the important authorities. its goal is to offer mortgage facilities up to rs 10 lakh to non-corporate and non-agricultural small/micro companies. PM Modi commenced it on April eight, 2015. in keeping with government statistics, within seven years because then, loans worth Rs 18.60 lakh crore had been disbursed beneath the scheme.

Q: How much Mudra loan can I get?

Ans: The maximum loan amount under the Mudra Loan Scheme is Rs. 10 lakh. The loan amount can be repaid over five years. The applicant does not have to deposit any security with the banks or credit institutions to apply for a Mudra loan.

Q: Which banks are offering Mudra Loan?

Ans: Loans under the Mudra Loan Scheme are offered by HDFC Bank, Axis Bank, Bank of Baroda, Indian Bank, State Bank of India, and Punjab National Bank.

Suggested Link: Our Jharkhand

@MAN